LED REAL ESTATE COMPLIANCE RECOVERY PLATFORM

Our team of seasoned consultants specializes in providing strategic, compliance-led recovery advisory services that deliver measurable results.

This platform signifies a transformative shift in the way India approaches real estate litigation—redefining it from a liability into a value-generating asset class. By integrating law, finance, and technology, we are establishing India’s first structured, scalable, and profitable Real Estate Asset Recovery Infrastructure. Whether navigating government approvals, institutional partnerships, or corporate collaborations, we ensure a seamless, end-to-end process—from initiation to execution.

At L & L Consultants, we are driven by an unwavering commitment to professionalism, transparency, efficiency, and intelligence. Leveraging global best practices, we provide comprehensive support through meticulous planning, stakeholder coordination, and compliance management—delivering consistent value to our clients.

Proven Track Record

Proven track record of exceptional results, ensuring client satisfaction and success in real estate ventures.

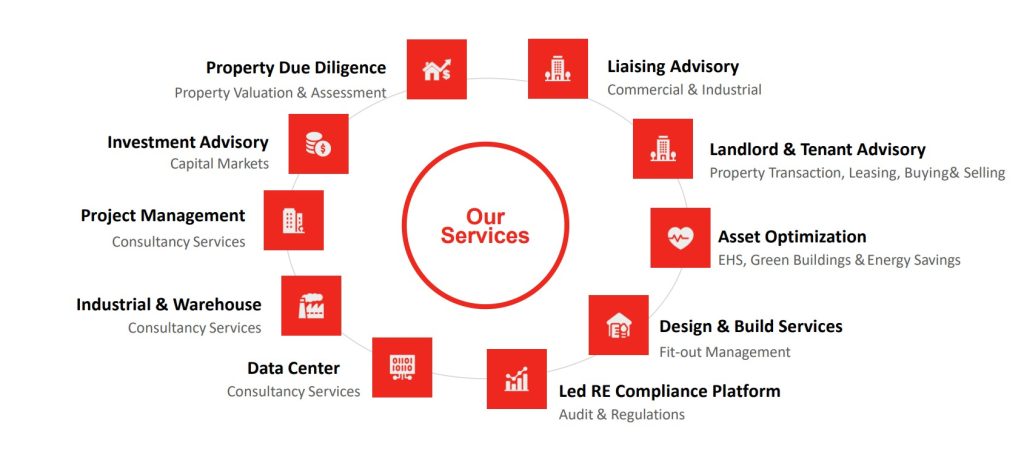

Extensive Services

We cater to all your liaising needs, ensuring a seamless experience from start to finish

Flexibility

We ensure your requirements are perfectly tailored to your needs by adapting our unique strategies

Expertise

Our team has extensive local and corporate market expertise, offering unmatched liaising expertise

Executive Summary

India’s real estate sector valued at over $400 billion (₹33 lakh crore) is burdened with over ₹1 lakh crore of trapped capita l in the form of disputed, encumbered, or distressed properties. Over 66% of India’s civil cases relate to land or property, making this on e of the country’s largest and most underserved asset recovery opportunities. Our venture aims to unlock this dead capital through an integrated Litigation-Led Real Estate Recovery Platform that merges law, real estate, finance, and technology.

The Problem

India’s legal and property ecosystems are fragmented, opaque, and capital-destructive. Thousands of stalled projects, title disputes,

and delayed handovers have locked billions of rupees. Average case resolution time exceeds 10 years, with multiple parallel forums

(RERA, NCLT, Civil Courts, SARFAESI). Traditional law firms lack capital and scale, while investors lack visibility and standardised

models to deploy funds into recoverable assets.

The Solution

We are building India’s first integrated platform that combines legal strategy, capital deployment, and real estate expertise to recover trapped value. The platform identifies viable litigation opportunities, funds them, drives resolution through partner law fir ms, and monetizes recovered assets via sale, redevelopment, or SPV-based structures.

How It Works

- Identify and triage real estate disputes using title and court data intelligence.

- Structure SPVs or claim assignments for selected cases.

- Fund litigation and resolution through a dedicated litigation finance pool.

- Engage top-tier legal and valuation partners for enforcement and recovery.

- Monetize recovered assets through sale, settlement, or redevelopment.

Market Opportunity

India’s civil litigation related to property disputes accounts for 66% of total pending civil cases. Over ₹1 lakh crore worth of real

estate is currently under dispute or stalled. Even a 10% penetration into this addressable market represents a ₹10,000 crore

opportunity. Government focus on judicial digitization, RERA enforcement, and asset monetization further strengthens tailwinds.

Business Model

- Success-based Litigation ROI Fee – 20%–40% of recovered value.

- SPV Equity Participation – Stake in recovered or redeveloped properties.

- Analytics & LegalTech SaaS Licensing – Data subscriptions for law firms, banks, and funds.

- Settlement Facilitation & Advisory – Fee-based recovery mandates.

- Asset Sale & Auction Fees – Monetization through registered marketplaces.

Technology Backbone

The platform will deploy AI-driven case analytics, risk scoring, and real estate intelligence modules. It will integrate with RERA

databases, court filings, and land registry APIs to build a real-time litigation dashboard. Predictive analytics will guide investment

decisions and case prioritization.

Competitive Landscape & Global Analogues

Globally, firms like Burford Capital (USA), Omni Bridgeway (Netherlands), and Hilco Real Estate (USA) have demonstrated high –

return litigation funding and asset recovery models. In India, similar structures exist only for financial NPAs (e.g., IIFL A RC,

NARCL). No player currently operates at the intersection of civil litigation, real estate, and investor capital.

Illustrative Case Examples

- Delhi NCR RERA Project: 500 buyers trapped, unified litigation, 2.5x ROI within 4 years.

- Chennai Title Dispute: ₹25 crore asset unlocked from ₹5 crore investment.

- Bengaluru PSU Land: Encroached property regularized and monetized via PPP model.

- Mumbai Redevelopment: Arbitration-funded resolution, project revived within 2 years.

Financial Projections & Returns

Pilot portfolio of ₹100 crore across 10–15 disputes with expected recoveries of ₹250–300 crore within 4–5 years. Target IRR: 25%–

35% (portfolio-weighted). Projected 5-year fund size: ₹1,000 crore with scalable SPV-based replication across Tier-1 and Tier-2

cities.

Investment Ask

Seeking ₹50 crore seed funding to establish legal-financial infrastructure, acquire an initial case pipeline, and deploy proprietary technology. Use of funds: 40% litigation capital, 30% tech and data stack, 20% operations, 10% regulatory & compliance setup.

Economic & Social Impact

- Unlock ₹1 lakh crore of trapped real estate value over the next decade.

- Accelerate dispute resolution and reduce court pendency.

- Provide liquidity to distressed homeowners, small developers, and investors.

- Promote legal-financial transparency and build trust in India’s property markets.

Conclusion

This platform represents a paradigm shift in how India views real estate litigation—from a liability to an asset class. By merging law,

finance, and technology, we aim to create India’s first structured, scalable, and profitable Real Estate Asset Recovery Infrastructure.

Our Comprehensive RE Portfolio Services